In May 2025, India’s passenger vehicle (PV) market posted nearly flat growth on the surface, but a closer look reveals a different narrative—one fueled by the unstoppable rise of utility vehicles (UVs). According to the data released by the Society of Indian Automobile Manufacturers (SIAM), while overall car sales hovered around the same levels as the previous year, the UV segment continued to surge, providing much-needed momentum to an otherwise sluggish market.

This uneven growth highlights the shifting consumer preferences in India’s automotive sector, driven by lifestyle aspirations, perceived value-for-money, and road conditions. Let’s dive into the figures and the dynamics behind this trend.

The Numbers: Flat Growth with a Utility Boost

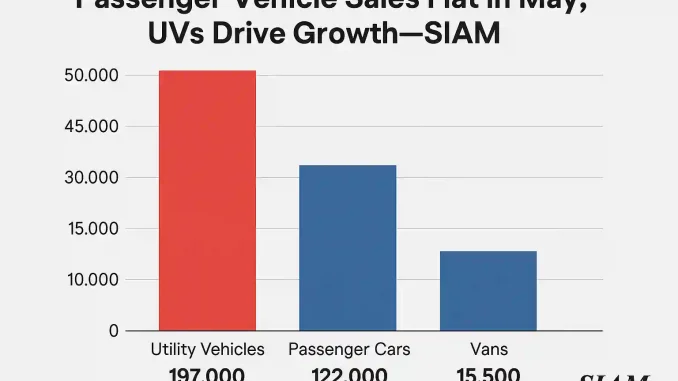

According to SIAM’s report, passenger vehicle wholesales in May 2025 stood at approximately 334,500 units, compared to 334,247 units in May 2024—a nominal increase of 0.08%. At face value, this suggests a stagnant market. However, breaking down the segments paints a more nuanced picture:

- Utility Vehicles (UVs): 197,000 units (up from 183,000 units)

- Passenger Cars (hatchbacks and sedans): 122,000 units (down from 135,000 units)

- Vans: 15,500 units (down marginally)

Clearly, utility vehicles were the sole bright spot, registering double-digit growth year-on-year and contributing to more than 58% of the total PV sales in May.

Why Utility Vehicles Are Winning

The meteoric rise of UVs—especially compact and mid-size SUVs—has fundamentally changed the PV market landscape in India. There are several factors behind this shift:

1. Changing Consumer Preferences

Modern Indian consumers now prefer vehicles that offer a commanding road presence, higher ground clearance, and flexibility for both city and long-distance travel. UVs check all these boxes, while also being seen as status symbols among aspirational buyers in Tier 2 and Tier 3 cities.

2. Competitive Offerings Across Price Points

Manufacturers are now offering SUVs and crossovers across a wide price spectrum—from sub-₹10 lakh compact UVs like the Tata Nexon and Hyundai Venue, to premium offerings like the Mahindra XUV700, Toyota Hyryder, and Hyundai Creta. This democratization of UVs has made the segment accessible to a broader base.

3. Feature-Rich Vehicles

Today’s UVs come packed with features such as ADAS (Advanced Driver Assistance Systems), panoramic sunroofs, connected car tech, and improved fuel efficiency—all without a significant price hike. These features attract tech-savvy urban youth and families alike.

4. Better Resale and Perceived Value

UVs also enjoy better resale value, giving buyers an extra sense of security and long-term return on investment. Many now consider UVs to offer the best blend of space, safety, and resale, making sedans and hatchbacks less attractive.

Segment-Wise Analysis

Hatchbacks and Entry-Level Cars: Struggling for Relevance

The entry-level hatchback segment continued its downward slide. Brands like Maruti Suzuki and Hyundai, which once dominated with best-sellers like the Alto and Santro, have witnessed declining volumes in these segments. Rising costs due to BS6 Phase II compliance, increasing insurance premiums, and overall affordability constraints have driven price-sensitive buyers toward the used car market or two-wheelers instead.

Sedans: A Shrinking Niche

Sedans are also becoming increasingly niche. Once considered aspirational, models like the Honda City or Hyundai Verna now face stiff competition from similarly priced compact SUVs, which offer better ground clearance and practicality.

Vans: Minimal Movement

The van segment remains largely stagnant with few new launches. Existing players like the Maruti Eeco continue to sell steadily in rural and semi-urban markets for commercial use, but lack any substantial innovation or new product momentum.

Two-Wheelers and Commercial Vehicles: Signs of Recovery

While PVs remained flat, SIAM reported moderate growth in the two-wheeler segment, driven by rural demand, marriage season-related purchases, and easing input costs. Commercial vehicle sales also showed a slight uptick, reflecting improved infrastructure activity and a stabilizing economy.

What Automakers Are Saying

Industry leaders have acknowledged the dominance of UVs while also expressing caution about the overall market:

- Shashank Srivastava, Senior Executive Director at Maruti Suzuki India, noted, “The UV segment continues to outpace all others. However, demand in the entry-level segment is under pressure due to affordability challenges.”

- Tarun Garg, COO of Hyundai Motor India, stated, “We’re witnessing sustained traction for SUVs, both ICE and EV. It’s clear that consumer priorities have shifted, and we’re aligning our product pipeline accordingly.”

Looking Ahead: The Road to Growth

Despite the flat numbers in May, the auto industry remains cautiously optimistic about the second half of 2025. Factors contributing to this sentiment include:

- Upcoming festive season: The September–November window often boosts PV sales significantly.

- New launches: Several major SUV and EV launches are lined up for later this year from brands like Maruti Suzuki, Toyota, and Kia.

- Electric vehicle growth: While currently small in volume, the EV segment—especially electric UVs—is poised for exponential growth in the next few quarters.

SIAM also expects that with stable fuel prices, improving rural sentiment, and increasing disposable income, broader recovery across all PV segments could be on the horizon.

Leave a Reply