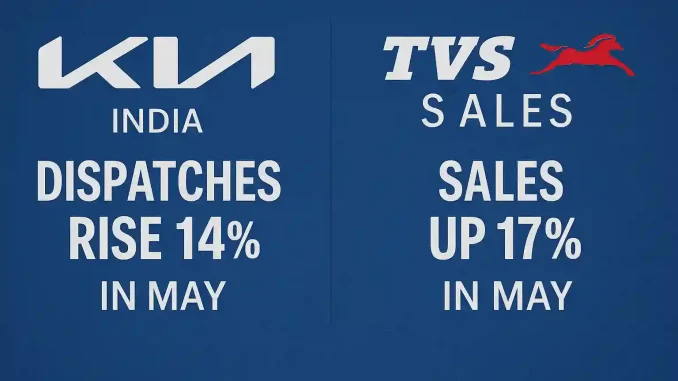

India’s automobile sector continues to show signs of recovery and resilience as Kia India and TVS Motor Company both reported strong sales numbers for May 2025, signaling rising consumer sentiment and improved production dynamics. While Kia India registered a 14% year-on-year increase in vehicle dispatches, TVS Motor Company posted an impressive 17% growth in overall sales, bolstered by strong demand across domestic and export markets.

These results reflect not just individual brand performance but also an underlying revival of momentum in the broader passenger and two-wheeler markets, which have faced numerous headwinds in recent years ranging from chip shortages and regulatory changes to macroeconomic uncertainty.

Kia India: Gaining Ground in a Competitive SUV Market

Kia India reported dispatches of 19,500 units in May 2025, a significant rise from 17,000 units in May 2024, marking a 14.7% increase year-on-year. This growth comes on the back of robust demand for its SUV lineup, with the Seltos, Sonet, and Carens continuing to dominate their respective segments.

Key Highlights:

- Seltos, Kia’s best-selling model, accounted for over 8,000 units, buoyed by the facelift introduced last year with upgraded features, including ADAS and a panoramic sunroof.

- The Sonet compact SUV continued its popularity in urban markets, particularly among young, first-time buyers.

- The Carens MPV witnessed sustained traction in the family and fleet segments, with over 4,000 units dispatched.

- Exports also remained strong, with Kia India shipping more than 5,000 units to over 90 countries, reinforcing India’s role as a key export hub for the brand.

Industry Perspective:

Myung-sik Sohn, Chief Sales and Business Strategy Officer at Kia India, noted,

“We are encouraged by the sustained customer interest in our products. Our focus on tech-enabled, feature-rich, and design-forward vehicles is clearly resonating with Indian consumers.”

Kia also hinted at new product launches in the second half of 2025, including a compact EV expected to enter production at its Anantapur plant, furthering its electrification goals.

TVS Motor Company: Two-Wheeler Revival in Full Swing

TVS Motor Company, one of India’s leading two- and three-wheeler manufacturers, reported total sales of 370,000 units in May 2025, compared to 316,000 units in the same month last year—translating to a solid 17% year-on-year growth.

This performance was driven by higher domestic demand, a revival in rural spending, and growing interest in the company’s electric vehicle portfolio.

Segment-wise Breakdown:

- Domestic two-wheeler sales rose to 290,000 units, up from 255,000 last year.

- Exports also showed resilience, contributing 80,000 units, aided by easing global freight constraints and improved demand in Latin America and Africa.

- TVS iQube, the company’s flagship electric scooter, saw sales cross 19,000 units, reflecting strong acceptance of EVs among urban consumers.

- Motorcycles (such as the Apache series) and mopeds (like the XL100) both saw stable growth, supported by marriage season demand and improved financing availability.

Company Statement:

TVS Motor’s official statement read:

“With positive trends in both the ICE and electric vehicle categories, we’re optimistic about the quarters ahead. Our EV infrastructure expansion and new launches are aligned with consumer demand and sustainability goals.”

The company is also planning to expand its EV portfolio by launching new electric motorcycles in the premium and commuter segments by early 2026.

Broader Implications for the Auto Sector

The healthy performance by Kia India and TVS Motor is part of a larger trend of sector-wide stabilization and targeted growth, particularly in segments where innovation, affordability, and feature differentiation are driving consumer choices.

1. SUV Boom Remains Unshaken

The SUV segment continues to be the primary driver of growth in the passenger vehicle market, with most manufacturers seeing strong traction in this category. Compact and mid-size SUVs now contribute over 50% of total PV sales in India, a figure that is still rising.

2. Two-Wheelers Regain Momentum

Rural recovery, a better monsoon forecast, improved credit availability, and urban EV adoption have brought two-wheelers back into the spotlight, reversing years of flat or declining growth post-COVID.

3. Exports Resilient but Watchful

While global uncertainties persist, brands with diversified export markets, like TVS and Kia, have managed to maintain or grow their overseas shipments. However, manufacturers remain cautious due to geopolitical tensions, shipping costs, and fluctuating demand from African and Latin American markets.

Looking Ahead: Optimism with Caution

With the first quarter of FY26 nearing completion, most auto brands are entering the festive build-up period with cautious optimism. Several key launches are lined up, including new EVs, compact SUVs, and premium two-wheelers.

Industry analysts believe that:

- Fuel price stability, consumer financing schemes, and government EV incentives will play a crucial role in sustaining momentum.

- Supply chain normalization, particularly in semiconductors, has already helped production planning and inventory control.

- Brands will need to invest in tech, after-sales experience, and sustainability practices to stay competitive in a market where buyers are becoming increasingly informed and demanding.

Leave a Reply